Maryland Probate Process FAQs

What is probate?

Probate is the court-supervised process of identifying and distributing the assets of someone who has died (the "decedent"). A will typically dictates how assets are distributed, but if there is no will, Maryland law determines who inherits what.

How long does probate take?

If an estate is insolvent - the expenses and debts exceed the assets - the Register's office will open and close it the same day. If the estate is solvent, most creditors have 6 months to file a claim, so that's the earliest an estate could close. Most estates close within a year of being opened, but they can be open longer if there is conflict among the interested persons.

What do I need to bring to the Register of Wills?

- Multiple copies of the certified death certificate

- The original will (if there is one)

- Car titles

- Funeral contract and expenses

- Names and addresses of interested persons

- Real estate deeds

- Your driver's license

What is a Personal Representative?

The Personal Representative is responsible for filing paperwork with the court and handling the estate. They must:

- Identify and value estate assets

- Secure and maintain estate assets

- File an estate inventory

- Notify creditors and pay valid debts

- Distribute property to beneficiaries

- Close the estate with the court

What happens if someone dies without a will in Maryland?

The government's intestate succession plan will decide who gets your property, based on your family members.

Which assets go through probate?

Probate assets are titled in the decedent's name alone. Non-probate assets (like jointly owned property) transfer outside of probate.

What are the most common mistakes Personal Representatives make?

- Comingling funds

- Failing to maintain estate property

- Failing to insure or secure estate property

- Incorrectly valuing property

- Not communicating with beneficiaries

- Not understanding taxes

- Improper distributions

What about real estate in probate?

Beneficiaries can decide what to do with real estate, such as keep it, sell it, or buy each other out. If real estate is located outside of Maryland, a separate probate may be needed.

Do I need a lawyer?

Many estates are simple enough that you may not need to retain legal counsel. However, if you feel overwhelmed by having to handle an estate, if there is conflict in the family, or there are complex assets involved, you should consider hiring an attorney to take over the estate for you.

Are there fees?

The Register's fees are set by the Maryland General Assembly and vary depending on the value of the estate. There is no fee for a Small Estate, however there is a fee for a Regular Estate. Please consult the Register of Wills website for a full breakdown of the probate fee schedule.

Do I have to pay taxes?

There may be tax issues to address after someone has passed away. If you have questions about estate taxes, you should contact an attorney, the Comptroller, or the IRS. The Registers of Wills do, however, collect Maryland inheritance taxes. This is a flat 10% tax based on the relationship of the individual inheriting, whether it is a probate or non-probate transfer. Spouses, registered domestic partners, descendants, ancestors, siblings, and stepchildren are exempt. If you have a question about the inheritance tax, call the Register's office.

Will I go before a judge?

If there is disagreement among family members, the Orphans' Court may hold a hearing. Otherwise, all Regular Estate accounts and petitions go before the court, while most Small Estates and estates in Modified Administration never require action by the court. Most estates are handled exclusively by the Register of Wills' staff and do not involve the court.

A loved one has passed away. Where do I start?

After someone close to you has passed away, your responsibilities depend on if they had a will, if they had assets titled solely in their name ("probate assets"), and the value of those assets. Assets can include real property (homes or land), motor vehicles, any kind of financial accounts, tangible items owned by the decedent, and more.

- If the decedent died with no will or probate assets: You don't need to open an estate and don't have anything to file with the Register of Wills.

- If the decedent died with a will but no probate assets: You will need to file their Last Will & Testament with the Register of Wills. This is required to ensure that if any probate assets are ever located, the decedent's final wishes regarding who would serve as their personal representative (also known as an "executor") and who would inherit are both honored. There is no fee for filing the will.

- If the decedent died (with or without a will) with probate assets: You will need to file the will (if any) and petition to be appointed personal representative of the estate. The Register of Wills will guide you on which papers are required, how to account for the assets, and which type of estate you'll need to open.

How do I open an estate?

To open an estate and be appointed Personal Representative, you'll need to bring in or mail some documents to the Register of Wills in the jurisdiction (the county or Baltimore City) in which the decedent was domiciled (their permanent home). You'll need to provide the following: Last Will and Testament (original, unless only a copy can be located), Death certificate (copy or original) or any proof of death, Date of death value of probate assets & debts (including funeral bill), Title to motor vehicles (original or copy), Names and addresses of "interested persons" (all heirs and legatees), Nominal Bond (depending on the value of the estate), Filing fee.

Who will inherit?

If the decedent died with a Last Will & Testament, we will follow the terms of the will to determine who will inherit, provided the estate is solvent and the assets and funds are available. If they died without a Last Will & Testament, they are considered to have died "intestate," and Maryland law determines who inherits based on which heirs survived the decedent. This begins with the spouse or registered domestic partner, then children and grandchildren, then parents, then descendants of parents (siblings, nieces, and nephews), etc. The Register of Wills can assist with determining who the heirs are. If we cannot locate any blood relative as far removed as descendants of the decedent's grandparents or any stepchildren, an estate will "escheat" and will be distributed to the local Board of Education.

What types of estates are there?

- Will of No Estate: Used when the decedent died with a will and no probate assets. There is no fee.

- Small Estate: Used when assets total $50,000 or less. A simple list of assets and debts is required. If the assets don't exceed the funeral expenses and family allowances you won't be required to publish notice of the estate in the newspaper. In rare cases, you may need a bond.

- Regular Estate: Used when assets exceed $50,000. An initial estimate of the value of the estate is required, then you are given 3 months to file a formal inventory of assets, and 9 months to file a first account. The Register's auditors will assist with this process. The accountings are subject to approval by the Orphans' Courts.

- Modified Administration: Used as a more streamlined alternative to a Regular Estate, when all heirs and legatees consent and the estate can be closed within 10 months. Instead of a formal inventory and account, a final report is required and reviewed by the Register of Wills. These estates are not subject to approval by the Orphans' Courts.

RESOURCES

For more information, visit us online at registers.maryland.gov.

Disclaimer: This brochure is provided for informational purposes only and does not constitute or is intended to constitute legal advice. Please consult an attorney for any legal advice.

Source of Information

This instructional material were sourced from "Probate Process in Maryland: Everything You Need to Know, Explained by an Estate Attorney" By Greg Jimeno For original documents and further legal resources, please visit HERE

Other information was sourced from the Maryland Registers of Wills, You can view that here HERE

Welcome to our Maryland Register of Wills resource page.

This curated collection of legal documents aims to serve the diverse needs of individuals and professionals alike. The forms provided here cover a broad spectrum of proceedings, such as probate, tax filing, guardianship, and estate management, among others. Each form is available in PDF format for your convenience. Additionally, instructions are available to guide you through the form-filling process. Please note that all forms and instructions are linked and will open in a new tab for your convenience. We encourage you to review the appropriate forms and their accompanying instructions carefully to ensure the accuracy and completeness of your legal filings feel free to reach out to us to if you have any questions!

General Probate Forms

- Proof of Execution of Will (50kb))Form RW1102

- Petition for Administration of a Small Estate (169kb)Form RW1103

- List of Interested Persons (77kb)Form RW1104

- Appointment of Resident Agent (122kb)Form RW1106

- Order for Small Estate (292kb)Form RW1108

- Small Estate Notice of Appointment Notice to Creditors Notice to Unknown Heirs (102kb)Form RW1109

- Notice to Interested Persons (49kb)Form RW1110

- Petition for Administration of Regular Estate (174k)Form RW1112

- Notice of Judicial Probate (65kb)Form RW1113

- Notice of Appointment Notice to Creditors Notice to Unknown Heirs (83kb)Form RW1114

- Bond of Personal Representative (55kb)Form RW1115

- Nominal Bond of Personal Representative (54kb) Form RW1116

- Waiver of Bond (60kb)Form RW1117

- Consent to Appointment of Personal Representative (61kb)Form RW1118

- Administrative Probate Order (63kb)Form RW1119

- Personal Representative's Acceptance and Consent (68kb)Form RW1121

- Inventory Summary and Supporting Schedule (328kb)Form RW1122

- Inventory Supporting Schedule (268kb)Form RW1123

- Information Report (88kb)Form RW1124

- Application to Fix Inheritance Tax on Non-Probate Assets (92kb)Form RW1125

- Election to Take Elective Share of Estate (Spouse) (178kb)Form RW1126

- Election to Take Elective Share of Estate (Other) (599kb)Form RW1126A

- Notice of Extension of Time to Elect Statutory Share (615kb)Form RW1127

- Claim Against Decedent's Estate (71kb)Form RW1128

- Notice of Disallowance (18kb)Form RW1129

- Petition and Order for Funeral Expenses (106kb)Form RW1130

- Notice of Caveat (69kb)Form RW1131

- Public Notice of Caveat (62kb)Form RW1132

- Application by Foreign Personal Representative to Set Inheritance Tax (117kb)Form RW1133

- Notice to Creditors of Appointment of Foreign Personal Representative (280kb)Form RW1134

- Petition for Administration of a Will of No Estate (117kb)Form RW1135

- Regular Estate Schedule A (59kb)Form RW1136

- Small Estate Schedule B (81kb)Form RW1137

- Consent to Compensation for Personal Representative and/or Attorney - Calculated Form (104kb)Form RW1138

- Claim for Refund of Tax Erroneously Paid (34kb)Form RW1140

- Election of Personal Representative for Modified Administration (549kb)Form RW1141

- Consent to Election for Modified Administration (544kb)Form RW1142

- Final Report Under Modified Administration with Certificate of Service (Form 1144) (585kb)Form RW1143

- Certificate of Service of Final Report Under Modified Administration (529kb)Form RW1144

- Consent to Extend Time to File Final Report and to Make Distribution in a Modified Administration (262kb)Form RW1146

- Petition for Limited Orders (529kb)Form RW1147

- Schedule C Request for Limited Order (531kb)Form RW1148

- Limited Order to Locate Will (520kb)Form RW1149

- Limited Order to Locate Assets (265kb)Form RW1150

- Affidavit of Attempts to Contact, Locate, and Identify Interested Persons (1,461kb)Form RW1151

- Request for and Consent to Further Extend Time to File a Final Report and to Make Distribution in a Modified Administration (952kb)Form RW1152

- Affidavit of Attempt to Comply with Federal, State, and Local Laws Related to Firearms, Ammunition, and Destructive Devices (55kb)Form RW1153

- Request for Waiver of Fees (22kb)Form RW1220

- Petition to Distribute Subsequently Discovered Check (79kb)Form RW1243

- Certificate of Service (24kb)Form RW1285

- Consent to Probate of Copy of Executed Last Will and Testament (546kb)Form RW1429

- Petition for Admission of Copy of Executed Last Will and Testament (521kb)Form RW1430

New Estate Packets

- Modified Administration Packet

- Regular Estate Packet

- Small Estate Packet

- Limited Order Packet

- Foreign Proceedings Packet

Contact Us Today

Info@dudleyresources.com

Call (804)709-1954

9601 Gayton Rd Ste 207, Richmond, VA 23238

Source of Information

All forms and instructional materials are sourced from the Maryland Register of Wills. For original documents and further legal resources, please visit Here Maryland Register of Wills.

Glossary of Probate Terms: A Comprehensive Guide

The probate process involves various legal terms that can often be complex and difficult to understand. This glossary aims to Clear up these terms, providing a clear and concise explanation for each.

- Administrator:

- The person appointed by, and qualified before, the Clerk to administer the decedent’s estate when the decedent has no will or has a will that does not name an executor or all executors named decline to serve.

- Beneficiary:

- A person or entity entitled to receive a portion of the estate.

- Bond:

- A written promise, recorded in the Clerk’s Office, by the administrator to perform his or her obligations and duties.

- Certificate of Qualification:

- The written document created by the Clerk, under seal, at the time the personal representative qualifies to administer the estate. Sometimes referred to as “letters testamentary.”

- Clerk or Clerk’s Office:

- The Clerk of the Circuit Court that has jurisdiction to probate the will and appoint the administrator or executor of the estate.

- Commissioner of Accounts:

- The person appointed by the Court to oversee the reports and activities of personal representatives.

- Court:

- The Circuit Court that has jurisdiction to probate wills and to qualify administrators and executors.

- Creditor:

- A person or organization owed money by the decedent.

- Decedent:

- The deceased person.

- Estate:

- The decedent’s property, including real estate, personal property and any other assets owned or controlled by the decedent at the time of his or her death.

- Executor:

- The person named in the decedent’s will to administer the estate who accepts appointment by qualifying before the Clerk.

- Fiduciary:

- A person in a position of trust with respect to another’s property; a general term used to refer to executor, administrator or trustee.

- Heirs/Heirs at Law:

- The persons who would inherit the decedent’s estate if the decedent died intestate, as determined by law at the time of the decedent’s death.

- Intestate:

- Dying without a will.

- Intestate Succession:

- The order in which family members are to inherit property from a decedent who dies intestate, as set forth at Virginia Code Sections 64.2-200 and 64.2-201.

- Inventory:

- The list or schedule describing the decedent’s assets over which the personal representative has authority. (Clerk will provide a printed form.)

- Legatee:

- A person who may inherit property under a will; a more technical name for beneficiary.

- Notice of Probate:

- The required notice of certain information given to beneficiaries and heirs. (Clerk will provide a printed form.)

- Personal Representative:

- A term used to mean either the executor or the administrator of the estate, as the context requires.

- Probate:

- The procedure whereby a will is admitted to record in the Clerk’s Office; the process of qualifying a person as executor or administrator of an estate; also sometimes used generally to refer to the entire process of administering an estate.

- Qualification:

- The procedure whereby a person is appointed by the Clerk to serve as executor or administrator of a decedent’s estate.

- Self-Proving Affidavit:

- An affidavit, given under oath, by the testator and witnesses, and notarized, that proves the Will was signed and witnessed in accordance with Virginia law.

- Testate:

- Dying with a will.

- Testator:

- A person who makes a will.

- Will:

- A written document that directs how, when, and to whom the Testator wants his or her property distributed after death.

How to Start Probate: A 12-Step Guide

Losing a loved one is difficult. Settling their estate through probate can add extra stress. This 12-step guide breaks down the probate process to make it more manageable.

- Step 1: Locate the Original Will: The first step is finding the deceased's original will, not a copy, which states who inherits their assets. The probate court requires the original document. Check filing cabinets, desks, and safe deposit boxes. If you can't locate the original will, check with lawyers, accountants, or the local probate court.

- Step 2: Get Death Certificates: You'll need several certified death certificates as proof of death. Order at least 10 copies from the mortuary or vital records department.

- Step 3: Gather Documents: Collect important paperwork like insurance policies, bank statements, appraisals, property inventories, tax returns, and stock/bond info. Organize everything in labeled folders.

- Step 4: Determine if Probate is Necessary: Sometimes you can avoid formal probate if assets are below $100k or were transferred outside probate (like jointly owned property or accounts with beneficiaries).

- Step 5: Choose Simple or Formal Probate: Most states offer an expedited "summary administration" process for smaller estates. Check your state's limit. Use formal probate for complicated or high-value estates.

- Step 6: Check State Probate Deadlines: Some states require probate within 3-4 years of death. Simple probate may have a shorter deadline. Verify your state's laws.

- Step 7: Understand the Court Appoints an Executor: Courts usually honor the executor named in the will. Without a will, state law determines priority. Family can also petition to start probate.

- Step 8: Petition the Court to Name an Executor: File the will, death certificate, and application with the court to name an executor. They administer the estate and appear in court.

- Step 9: Attend the First Hearing: At the initial hearing, interested parties can object to the executor appointment. This is usually just a formality.

- Step 10: Send Notices to Creditors and Heirs: The executor must notify creditors and beneficiaries of probate. Publish a notice in the local newspaper for unknown creditors.

- Step 11: Post a Bond if Required: The court may require the executor to get an insurance policy to protect heirs from losses. This can often be waived.

- Step 12: Validate the Will: Witness statements or affidavits prove the will is valid. This must happen before assets are distributed.

The probate process takes time, but following these steps helps it go smoothly. Let us know if you need probate assistance!

Welcome to our Circuit Court Forms resource page.

This curated collection of legal documents aims to serve the diverse needs of individuals and professionals alike. The forms provided here cover a broad spectrum of proceedings, such as probate, tax filing, guardianship, and estate management, among others. Each form is available in PDF format for your convenience. Additionally, instructions are available to guide you through the form-filling process. Please note that all forms and instructions are linked and will open in a new tab for your convenience. We encourage you to review the appropriate forms and their accompanying instructions carefully to ensure the accuracy and completeness of your legal filings if you have any questions feel free to reach out to us to if you have any questions!

Probate Court Forms

Information Forms

General

- Addendum to Petition for Appointment of Guardian or Conservator- Under Seal (Form # CC-1642)

- Report of Guardian for an Incapacitated Person Probate Tax Return (Form # CC-1644) - Instructions

- List of Heirs (Form # CC-1611) - Instructions

- Certificate of Creditor or Person Other Than a Distributee (Form # CC-1609) - Instructions

- Consent of Nonresident Fiduciary for Service of Process (Form # CC-1610) - Instructions

- Real Estate Affidavit (Form # CC-1612) - Instructions

- Notice Regarding Estate (Form # CC-1616) - Instructions

- Affidavit of Notice Regarding Estate of (Form # CC-1617) - Instructions

- Waiver of Notice of Probate or Qualification (Form # CC-1618) - Instructions

- Power of Attorney for New or Additional Bond (Form # CC-1619)

- Petition for Amendment of a Death Certificate (Form # CC-1453)

Inventory

Accounting

- Account for Decedent’s Estate (Form # CC-1680) - Instructions & Sample

- Statement in Lieu of Settlement of Account for Decedent’s Estate Pursuant to Va. Code §64.2-1314 (Form # CC-1681) - Instructions

- Account for Incapacitated Adult (Form # CC-1682) - Instructions & Sample

- Account for Minor (Form # CC-1683) - Instructions & Sample

- Account for Trust (Form # CC-1684) - Instructions & Sample

Wills

- Deposition of Witness to Will Without Self-Proving Clause (Form # CC-1601) - Instructions

- Deposition of Witness to Prove Holographic Will (Form # CC-1602) - Instructions

- Deposition of Witness to Prove Signatures of Deceased Attesting Witnesses and of the Testator (Form # CC-1603) - Instructions

- Proof of Holographic Will and Proof of Will of Person in Military Service (Form # CC-1604) - Instructions

- Waiver of Qualification (Form # CC-1608) - Instructions

Contact Us Today

info@dudleyresources.com(804)709-19549601 Gayton Rd. Henrico, Virginia 23238Source of Information

All forms and instructional materials are sourced from the Virginia Judicial System's Self-Help Website. For original documents and further legal resources, please visit Virginia Judicial System Self-Help Probate Forms.

FAQ

FAQ

What is Probate?

Probate is the legal process for sorting out someone's assets after they die. It involves validating the will, tallying up assets, paying off debts, and passing out remaining property & assets to the heirs.

When Do You Need Probate?

You need probate if the deceased person owned anything solely in their own name with no beneficiary attached. Assets with joint owners, beneficiaries, or held in a trust can avoid probate.

How Long Does Probate Take?

On average, the probate process can take 6-12 months or more. It's a drawn-out process of noticing creditors, getting appraisals, filing taxes, and more before heirs can collect their inheritance.

What Assets Pass Through Probate?

Probate involves real estate, vehicles, bank accounts, businesses, and personal items without a named beneficiary.

Who's Involved in Probate?

The cast of probate players includes the executor, probate lawyer, appraisers, court-appointed administrators, money-owed creditors, tax collector, and inheriting heirs.

What forms do I need to complete and where do I find them?

CLICK HERE TO VIEW FORMS FOR VIRGINIA

CLICK HERE TO VIEW FORMS FOR MARYLAND

The Virginia Judicial System has a number of forms for each court available on the court's form page. You can also access forms by entering the form number or a keyword in the search box on the court's form page, which is located in the upper right hand corner of each page above the navigation column.

How are Assets Valued during probate?

Executors get official appraisals of the high-value items to tally date-of-death values for inventory and taxes.

Who Gets Paid First?

Sale proceeds from liquidated assets get routed to pay off outstanding debts, taxes, and legal fees before leftover money goes to the heirs.

How are Assets Sold during probate?

Executors sell off assets at reasonable market value, often hiring real estate agents and auctioneers to handle the sale of the assets.

Why Use auctions for your probate needs?

Auctions efficiently convert assets into cash while competitive bidding drives top dollar prices.

What Gets Auctioned?

Auction can include real estate, businesses, vehicles, equipment, jewelry, art, antiques, household goods, and anything unique.

How are Auctions Tracked?

Auctioneers provide detailed settlement statements for executors to account for inventories, tax forms, and court reports.

How is Auction Payment Collected?

Auctioneers gather up the sale funds from winning bidders and cut checks to the estate after taking out expenses.

How Fast Can Auctions Happen?

With court approval, auctions can typically happen within weeks, allowing quick asset liquidation and inheritance payout.

How Do I Pick an Auctioneer?

When handling probate assets, use a licensed, bonded, and insured auctioneer. Licensing verifies expertise in conducting legal auctions. Bonding protects against missing assets or funds due to auctioneer negligence. Insurance covers liability for any onsite injuries or accidents. An ethical, experienced auctioneer will carry these protections and have strong relationships with probate courts, attorneys and appraisers. Verify licensing, bonding and insurance to choose a trustworthy probate auctioneer to settle estates smoothly.

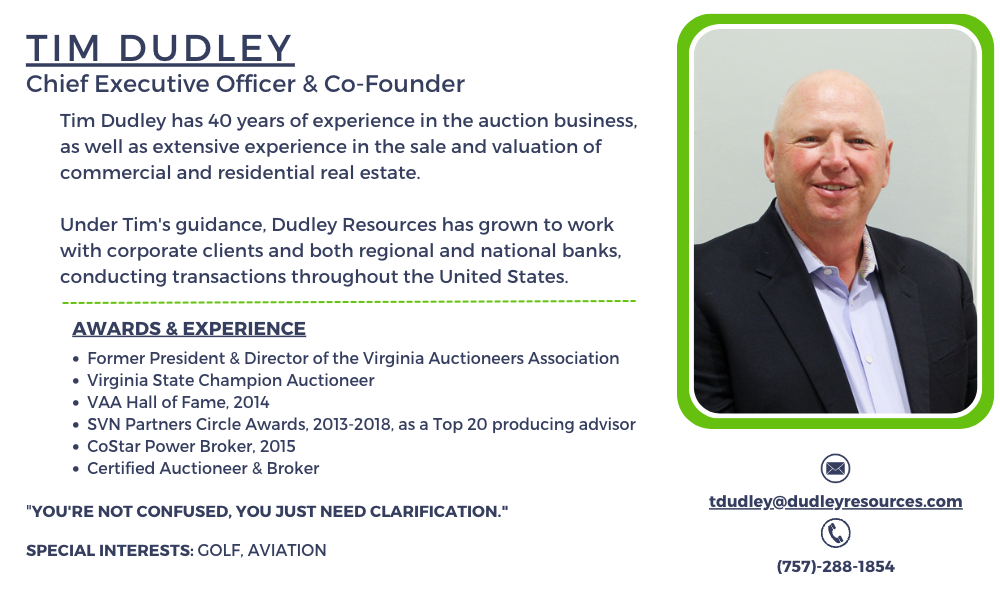

Why Use Dudley Resources?

With over 60 Combined years of experience we have seen it all. We are licensed, bonded, and insured auctioneer's and have the infrastructure in place to handle every aspect of the sale including, personal property, real estate, vehicles, equipment, and business assets, if repairs are needed, if funds are needed. We can do it all. A one-stop shop to handle all of your estate needs

What if I need money at the start of probate?

We understand executors often need funds early in probate to cover initial costs before assets are sold. If you need an advance to handle urgent expenses in the first few weeks, let us know.

We can provide funds to pay for costs like cleaning out the property, appraisals, repairs, utilities, taxes, legal fees and other pressing probate expenses. The advance would be secured against assets in the estate and deducted from auction proceeds.

Getting an advance early allows you to preserve and prepare assets for sale, which ultimately benefits the heirs. Let us know if an upfront advance would help smoothly start and move probate forward.

What Financial Assistance can I get if I have assets but no cash?

Typical uses include property repairs/maintenance, utility/tax bills, mortgage payments, legal fees, appraisal costs, cleaning out the home, and any other pressing estate costs.

Looking for More?

CLICK HERE for the complete guide on the probate process brought to you by the VBA (Virginia Bar Association)

Welcome to Dudley Resources: Your Probate Solutions Partner

Losing a loved one is hard enough without the burden of untangling their estate. Probate can drag on for months as assets are valued, debts paid, and the remaining inheritance distributed. But there's a faster, more efficient way to convert property to cash and get beneficiaries their rightful inheritance.

With probate auctions, our licensed auctioneers market assets to maximize competitive bidding, achieving top dollar prices. We efficiently liquidate real estate, vehicles, jewelry, art, antiques, equipment, and other probate assets. Sales are conducted online using our state-of-the-art bidding platform to maximize exposure and sale price

Our team handles every detail, working closely with executors, appraisers, courts, and heirs to move the disposition process along quickly and smoothly. We collect all sale proceeds from winning bidders and provide detailed settlement statements for court accountings. Let us alleviate the burden so you can gain closure, pay off debts, and distribute inheritance to loved ones. Call today to settle estates faster and easier with Dudley Resources

Probate Simplified

Probate is the legal process through which the validity of a will is established before assets can be distributed to beneficiaries. This intricate and time-consuming process demands over 550 hours of meticulous work. The Executor of the Estate holds a solemn duty to fulfill the Testator's wishes, including assessing liabilities, valuing the estate, settling debts, and distributing assets according to Virginia's laws and the will. Failure to do so can lead to legal liabilities.

Expert Guidance

Navigating the complex probate process can be overwhelming, with its numerous forms and court-mandated timelines. Dudley Resources comprises a team of seasoned professionals from diverse backgrounds, all dedicated to assisting you every step of the way. Our commitment lies in effective communication and prioritizing your needs, ultimately reducing stress and maximizing financial outcomes. We are your comprehensive resource for all probate-related matters.

Our Services Include:

Legal Assistance: We connect you with trusted local Probate Lawyers for Estate Planning and for Surviving Spouses.

Senior Move Management: Tailored support for Surviving Spouses, including social services.

Financial Expertise: Access to respected local CPA’s and accountants for matters such as life insurance, pensions, financial planning, 401ks, and tax filings.

Court Navigation: Assisting you in staying on track within court-set timetables and deadlines.

Appraisal Services: Our on-staff ASA Certified Appraiser, is here to assist you and ensure the fair and accurate valuation of assets, providing you with the peace of mind you deserve during these challenging times.

Unlocking Real Estate Wealth

Did you know that 70%-85% of all inherited wealth is tied to Real Estate? This is where most complications arise. We provide tailored solutions for your real estate needs, ensuring a favorable fiduciary outcome.

Our Real Estate Services Cover:

Property Sales: We facilitate property sales on your terms, within your timeframe, and at no cost to you.

Asset Security: Comprehensive protection for your assets.

Property Maintenance: Services include winterization, insurance updates, cleanouts, personal property sales, renovations, and more.

Contractor Work: Pre-sale punch work and rehabilitation to prepare the house for sale.

Service Contracts: Ensuring your property remains in top condition.

Debt Management: Paying off liens and debts to prevent foreclosure.

You're Not Alone

Facing probate challenges can be daunting, but you don't have to go through it alone. Reach out to us with a single phone call, and let Dudley Resources become your trusted partner during this challenging time. We are here to support all your probate needs. With Dudley Resources by your side, probate becomes a smoother journey towards securing your loved ones' legacies and assets.

Contact Us Today

info@dudleyresources.com(804)709-19549601 Gayton Rd. Henrico, Virginia 23238

What are Auction Sales? Can you tell me about your auctions and how they work?

Real estate auctions offer a unique and exciting experience, especially for those who haven't participated before. At Dudley Resources, we strive to create a welcoming environment for all bidders. Whether it's a live auction or an online-only event, the basic concept remains the same and is quite simple. If you wish to bid on a property, you can raise your bidder card or use the online bidding platform to place your bids. If someone outbids you, you have the option to raise your bidder card again or click the next bid button, continuing until you reach your maximum bid. If you're the highest bidder when the bidding ends, congratulations, you've successfully won the property's high bid.

Can Anyone Bid at the Special Commissioner Sales or at the Tax Delinquent Auction?

To qualify as a bidder in our auctions, you typically need to meet certain criteria. This includes not owing any delinquent taxes to the local taxing jurisdiction where the auction takes place and not being a defendant in any delinquent tax matters. Additionally, you'll need a valid state-issued driver's license or ID, or a verifiable home address with a military ID. If online bidding is available, there might be additional requirements to qualify for online participation. In some cases, for exceptionally valuable properties, you may be asked to provide proof of certified funds for registration. However, there is no fee to register and participate in our auctions, as they are open to the general public as long as the registration qualifications are met.

What is the difference between a Special Commissioner's Sale (Judicial Sale) and Non-Judicial Tax Sale?

There are two types of sales: Special Commissioner's Sale (Judicial Sale of Real Estate) and Non-Judicial Sale of Real Estate. A Special Commissioner's Sale is conducted under the order and approval of the local Circuit Court, ensuring proper notification of all interested parties. This type of sale transfers the property free and clear of liens upon confirmation by the Court. On the other hand, a Non-Judicial Sale is conducted without court oversight and is limited to specific parcels of real estate. Terms and conditions differ between these types of sales, so reviewing the specific Terms of Sale for each auction is crucial.

Is there a Minimum Bid for either the Judicial and Non-Judicial Tax Delinquent Auctions?

Regarding starting or minimum bids, it's important to note that the majority of tax delinquent properties do not have minimum bids. In a Judicial Sale of Real Estate, where all sales must be presented and confirmed by the local Circuit Court, bids should generally reflect the value of the property. Unrealistically low bids in comparison to the property's value may be rejected by the Special Commissioner or the Court. The bidding process varies depending on the auction type. In a live auction, the auctioneer typically starts with bids around the assessed or appraised value and gradually decreases until a bidder raises their hand or bidder card to start the bidding. The bidding then continues until the highest bid is determined. In an online auction, a minimum bid amount may be set, and bidding progresses from there until the auction closes.

Can you Bid Online for at all the Tax Auctions?

Online bidding is often permitted in our auctions, but it depends on the specific jurisdiction, the preference of the Special Commissioner, and the location of the auction. Our auctions can take different forms, including live-only, online-only, or virtual live/online formats. If you're unable to participate in an online auction, we strive to accommodate your needs, so feel free to contact us to discuss alternative options.

What if I can’t attend the Auction?

If you cannot attend a live auction, there are alternatives available. You may submit absentee or telephone bids, provided you meet the necessary requirements. It's important to note that in a live auction, the person bidding on your behalf will need to register themselves and bid in their own name. In the case of online-only auctions, allowing someone else to bid using your sign-in credentials carries certain risks, and you are solely responsible for all actions taken under your username and password.

Can I purchase the property before the Auction?

It's worth mentioning that purchasing a property before it goes to auction is not possible or legal in the Commonwealth of Virginia. Virginia offers a fair opportunity for everyone to purchase tax delinquent real estate through public auctions. If you'd like to stay informed about our upcoming auctions, you can sign up for email notifications to ensure you never miss an auction. We also have an App that keeps the bidding at your fingertips.

What is the Buyer's Premium?

A Buyer's Premium is a percentage of the high bid amount added to the total sales price to cover the costs of the sale. Typically, the Buyer's Premium is around 10% of the high bid amount. It's important to consider this additional premium when bidding on properties.

If I am the winning Bidder, will I be responsible for paying off the back taxes, interest, and fees?

When a property is sold at a Special Commissioner or Judicial sale, the title is transferred with a Special Warranty Deed, which means, all back taxes, penalties, interest, and fees are cleared, and the new owner assumes the responsibility for taxation from a specified date. The specific start date for taxation varies by locality and is typically announced at the auction.

If I am the winning Bidder, will I be responsible for any past Liens or Mortgages?

If you purchase a property with existing mortgages, judgments, past due HOA fees, IRS liens, or other encumbrances, you are generally not responsible for those debts. The delinquent tax sale process notifies all lien holders about the sale, giving them an opportunity to protect their interests. Virginia law allows properties to be transferred free and clear of any liens or encumbrances upon confirmation of the sale by the Circuit Court.

What is this “Confirmation of Sale” that I am waiting for?

"Confirmation of Sale" refers to a hearing that takes place after a Judicial Sale of Real Estate, usually 3-6 weeks following the auction. At this hearing, the results of the auction are presented to the Circuit Court Judge, who confirms or denies the sale of each property. Attending the Confirmation of Sale Hearing is not required for the high bidder, but the Special Commissioner will inform you of the results.

In the rare instance that a property doesn't sell at the auction or the sale isn't approved by the Court, it may be offered again at the next scheduled auction. Private sales of these properties are not permitted, as the localities are not the owners. All sales must go through the Court Appointed Special Commissioner and the auction process.

What If Property I am the high bidder on is not confirmed or not approved by the Circuit Court?

If the Court doesn't approve the sale of a property on which you were the high bidder, the Special Commissioner will refund your deposit in full.

What is the total amount owed on the Property?

The exact amount of back taxes on a property is not known to us, as it is not pertinent to the auction sale process. The Special Commissioner handles all the tax-related information, and as an auction company, we don't require that information. Properties can have varying levels of tax arrears, ranging from several years to even more. The amount owed on a property usually doesn't directly impact its auction price. While some localities may consider the amount owed, most are primarily concerned with obtaining a fair price and ensuring the property is in the hands of a new owner who will fulfill their tax obligations.

Can I get into the property before the Tax Delinquent Auction Sale?

Unfortunately, Virginia law does not permit the inspection of improved properties being sold for tax delinquency. We cannot grant permission to inspect such properties, and it's important for bidders to proceed with caution and account for potential renovation and system replacement costs when considering bids.

What if I buy a property, the property is confirmed through the Circuit Court and there are occupants?

As the new owner of an improved property, it becomes your responsibility to evict any occupants and remove any remaining personal possessions after the deed has been recorded. We recommend consulting with an attorney to understand your rights and obligations in the eviction process.

What if the current occupants damage the property before final settlement?

In the event that occupants cause damage to an improved property before final settlement, you are still obligated to complete the purchase as the contract owner. However, you may have an "insurable interest" in the property and should consult your insurance agent immediately to insure your interest in the property.

The property I am interested in purchasing has a Mobile Home on it, will that be conveying with the purchase?

Mobile homes (house trailers) are not considered part of the real estate sale unless they are fixed to the property with a permanent foundation and listed as an improvement in the tax records. Mobile homes and other titled items are classified as personal property and are not included in the sale of real estate. There are legal processes for gaining ownership of abandoned personal property on your land, and consulting an attorney is recommended for assistance.

Is the property surveyed or perked?

Determining if a property perks or has a current septic permit requires your own due diligence before bidding. You can check with the locality's Health Department or conduct other inspections to uncover any septic permit records. It's important to note that these costs for testing, surveying, and title searches are solely your responsibility and will not be reimbursed.

Why does this property not have an actual address?

Finding physical addresses for properties being sold can be challenging as unimproved properties may not have assigned addresses in public records. However, many localities offer online Geographic Information Systems (GIS) where you can look up real estate properties. We typically provide a copy of the GIS map on our website, along with other relevant property information. If available, we may also mention the nearest property with a physical address as a reference. However, please be aware that the GIS is not an official survey and may not accurately represent the property's location, size, or shape. Conducting your own due diligence research prior to bidding is recommended.

What deposit will I be required to pay?

Deposit Requirements can vary from Auction to Auction but typically, the credit card that you used to register your bidding account will be charged the initial deposit of $2500.00 , which is a part of the 10% buyers premium. For all parcels less than the value will be charged a flat fee. Please review the Auction Specific “Terms and Conditions” for each sale.

What are the payment requirements for this Auction Sale?

Payment requirements for our auctions vary depending on the type of sale. In Judicial Sales of Real Estate, payment in full on the day of the auction is generally not required. Instead, a partial down payment is collected, and the balance is due within a specified period after court confirmation. Non-Judicial Sales typically require full payment on the day of the auction. The specific payment terms for each auction, including down payment percentages and acceptable forms of payment, can be found in the Terms of Sale. I.e Personal checks, certified fund checks, credit card and cash. It's advisable to review the Terms of Sale for each auction and contact us if you have any questions or need clarification.

Do you offer any sort of financing options for the Special Commissioner Sale or Non-Judicial Sale?

We do not offer financing programs for our real estate auction sales. It's the responsibility of the purchaser to secure their own funding to complete the purchase. If you require financing, arranging it before bidding on any properties is important. Our sales are not contingent on obtaining financing or any other matters. All sales are final and sold As-Is, Where-Is, and If- Is.

We hope this provides you with a comprehensive understanding of real estate auctions and how they work. If you have any further questions or need additional information, feel free to contact us.

Unlock The Potential of Our Tax Sale Marketing

Benefit from our extensive auction marketing strategies to showcase your property in areas where we've already generated interest through our Tax Sale Marketing Campaigns. You have the flexibility to determine your auction terms, reserve price, and sale date. Let us work to secure the best outcome for you, all without any cost on your part—maximum benefits with zero expenses

Item Search Results

Dudley Resources’ Vehicle & Equipment division has 50+ years of experience in selling items in Richmond and across the country. These items range from and Classic Cars, Luxury Vehicles, and Hot Rods to Construction Equipment, Work Vans, and Pickup Trucks - and everything in between. We’ve handled sales comprised of a singular vehicle and sales with as many as 200; we’ve sold $500 Junk cars and $115k Dump Trucks.

Be sure to catch our “Weekly Public Virtual Auto Auction” every Tuesday, with the last Tuesday of each month being our monthly “Live Virtual Equipment & Auto Auction”.

We recognize that our team is the bridge between sellers and buyers, and this is a role we take seriously; we’re committed to hosting transparent auction sales that leave all parties satisfied with the outcome. Big or small, Dudley Resources gives it our all.

Stay up to date with the latest news from Dudley Resources!

_(6).png)

Dudley Auctions

9601 Gayton Road, Suite 207

Henrico VA 23238

phone: (804) 709-1954

email: info@dudleyresources.com

Welcome to Dudley Resources!

The Resource for All Things Real Estate & Asset Recovery.

Elevating assets above the current market, auction transactions are a time-proven method for generating interest and competitive offers from qualified buyers for real estate, auto, heavy equipment, and classic cars. With a focus on the future and the support of experience and best practices, Dudley Resources combines proven auction techniques with the latest technologies.

Our online auction platform provides a transparent process and a stress-free environment, accessible worldwide. With a rapidly changing market, values can be difficult to pinpoint, and no one wants to be left shortchanged. Auctions provide the perfect medium for buyers and sellers to determine real market value at the time of sale.

Members of our team are Certified Auctioneer Institute (CAI) and Accredited Auctioneer of Real Estate (AARE) designated and include a Virginia Auctioneer State Champions.

Current Auction Listings

Check back soon!

__footer.png?v=1628087212)